India is expected to produce an additional 11.4 million mt of crude steel in 2026, up from an estimated 154 million mt in 2025, according to the Steel Commodity Briefing Service data published by S&P Global Energy CERA in December.

“Excess supply has been weighing on prices, and the market needs new demand to absorb the surplus. Supply is expected to rise further as India works toward 300 million mt of capacity by 2030, and without adequate backing from domestic demand or exports, the market risks prolonged weakness,” a Mumbai-based trader said.

From a 2025 high of Rupees 52,750/metric ton ($586/mt) assessed by Platts, part of S&P Global Energy, May 6, the spot cut-to-length price of IS2062, 2.5-10 mm thick HRC stood at Rupees 42,800/mt Dec. 26, down 18.9%.

The government aims to continue its steel capacity goals beyond 2030 and is eyeing 500 million mt/year by 2047, with the ambition aided by a proposed Rupees 50 billion ($570

million) initiative to promote the adoption of clean steelmaking technologies, which will leverage Europe’s Carbon Border Adjustment Mechanism.

“The strength of domestic markets will all depend on the export volumes. With aggressive capacity expansion in India, mills will have to ship out the excessive quantities to hold the domestic market stable,” another Mumbai-based trader said.

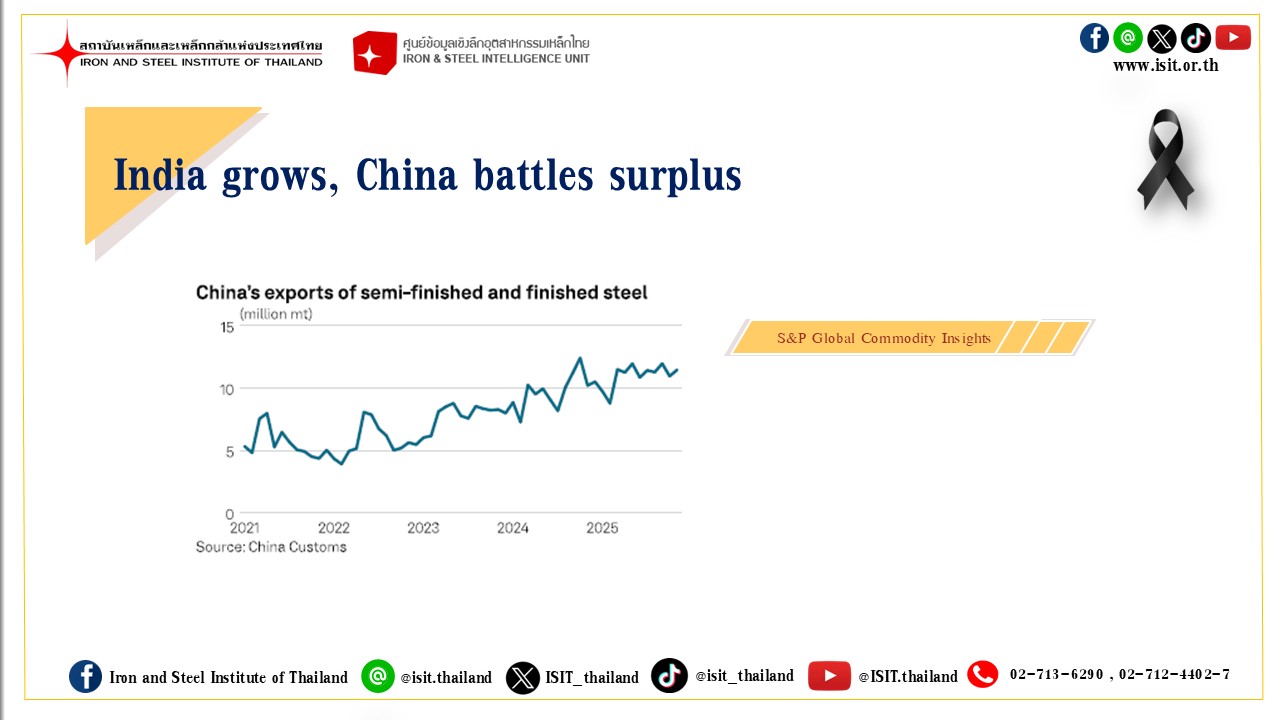

Meanwhile, China is contending with a steel surplus exacerbated by poor domestic demand and minimal efforts to reduce capacity.

China’s steel exports appear poised to set a record in 2025, continuing a trend of exporting in a bid to prevent inventory buildup. As a result, protectionism is likely to grow as countries with domestic steel industries implement antidumping duties and seldom-used safeguards.